Style Sampler

Layout Style

Search News Posts

General Inquiries 1-888-555-5555

•

Support 1-888-555-5555

Finance and Risk Analytics

Portfolio return calculation will be made in the desired date range using the data in the table below. You can see the portfolio return account over the last 21 working days.

DATE

CAC

DAX

DJI

SP

FTSE

NIKKEI

NASDAQ

VIX

04.01.2010

4013,96

6048,29

10583,95

4013,96

6048,29

10583,95

4013,96

6048,29

05.01.2010

4013,96

6048,29

10583,95

4013,96

6048,29

10583,95

4013,96

6048,29

06.01.2010

4013,96

6048,29

10583,95

4013,96

6048,29

10583,95

4013,96

6048,29

07.01.2010

4013,96

6048,29

10583,95

4013,96

6048,29

10583,95

4013,96

6048,29

08.01.2010

4013,96

6048,29

10583,95

4013,96

6048,29

10583,95

4013,96

6048,29

...

...

...

...

...

...

...

...

...

08.01.2022

4013,96

6048,29

10583,95

4013,96

6048,29

10583,95

4013,96

6048,29

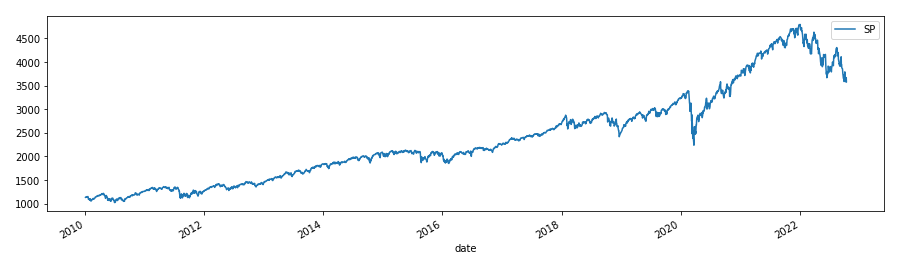

It shows the status of the S&P 500 stock index published by Standard & Poor's.

Click on Calculate Return button to see portfolio return results and maximum benefit.

SP

count 2943.000000

mean 2372.644913

std 977.094492

min 1022.580017

25% 1547.070007

50% 2109.409912

75% 2900.479980

max 4793.540039

Maximum Benefit : 1715.0

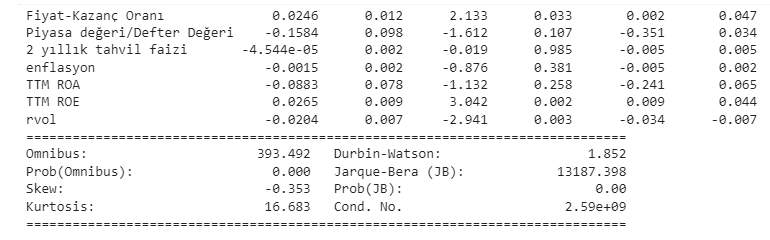

In this case study, Prediction modeling was done with Multivariate regression.

Click on the calculate button to see the portfolio return result!

Result:

As an example, downloading financial data from Yahoo Finance and investing.com via Python for company A is shown.