Style Sampler

Layout Style

Search News Posts

General Inquiries 1-888-555-5555

•

Support 1-888-555-5555

Finance and Risk Analytics

This case requires to develop a customer segmentation to give recommendations like saving plans, loans, wealth management, etc. on target customer groups.

The sample Dataset summarizes the usage behavior of about 9000 active credit card holders during the last 6 months. The file is at a customer level with 18 behavioral variables.

Following is the Data Dictionary for customer's credit card dataset :-

CUSTID : Identification of Credit Card holder (Categorical)

BALANCE : Balance amount left in their account to make purchases

BALANCEFREQUENCY : How frequently the Balance is updated, score between 0 and 1 (1 = frequently updated, 0 = not frequently updated)

PURCHASES : Amount of purchases made from account

ONEOFFPURCHASES : Maximum purchase amount done in one-go

INSTALLMENTSPURCHASES : Amount of purchase done in installment

CASHADVANCE : Cash in advance given by the user

PURCHASESFREQUENCY : How frequently the Purchases are being made, score between 0 and 1 (1 = frequently purchased, 0 = not frequently purchased)

ONEOFFPURCHASESFREQUENCY : How frequently Purchases are happening in one-go (1 = frequently purchased, 0 = not frequently purchased)

PURCHASESINSTALLMENTSFREQUENCY : How frequently purchases in installments are being done (1 = frequently done, 0 = not frequently done)

CASHADVANCEFREQUENCY : How frequently the cash in advance being paid

CASHADVANCETRX : Number of Transactions made with "Cash in Advanced"

PURCHASESTRX : Numbe of purchase transactions made

CREDITLIMIT : Limit of Credit Card for user

PAYMENTS : Amount of Payment done by user

MINIMUM_PAYMENTS : Minimum amount of payments made by user

PRCFULLPAYMENT : Percent of full payment paid by user

TENURE : Tenure of credit card service for user

DATE

CAC

DAX

DJI

SP

FTSE

NIKKEI

NASDAQ

VIX

04.01.2010

4013,96

6048,29

10583,95

4013,96

6048,29

10583,95

4013,96

6048,29

05.01.2010

4013,96

6048,29

10583,95

4013,96

6048,29

10583,95

4013,96

6048,29

06.01.2010

4013,96

6048,29

10583,95

4013,96

6048,29

10583,95

4013,96

6048,29

07.01.2010

4013,96

6048,29

10583,95

4013,96

6048,29

10583,95

4013,96

6048,29

08.01.2010

4013,96

6048,29

10583,95

4013,96

6048,29

10583,95

4013,96

6048,29

...

...

...

...

...

...

...

...

...

08.01.2022

4013,96

6048,29

10583,95

4013,96

6048,29

10583,95

4013,96

6048,29

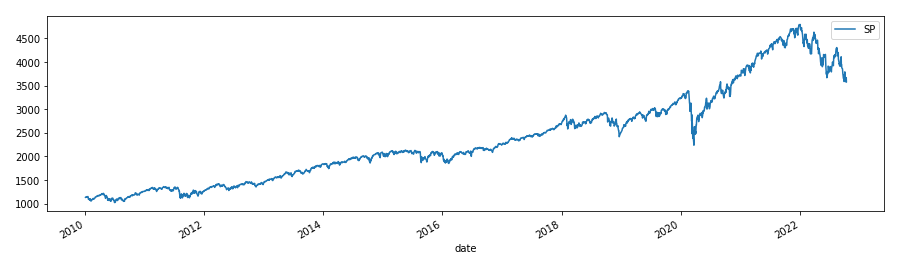

It shows the status of the S&P 500 stock index published by Standard & Poor's.

Click on Calculate Return button to see portfolio return results and maximum benefit.

SP

count 2943.000000

mean 2372.644913

std 977.094492

min 1022.580017

25% 1547.070007

50% 2109.409912

75% 2900.479980

max 4793.540039

Maximum Benefit : 1715.0

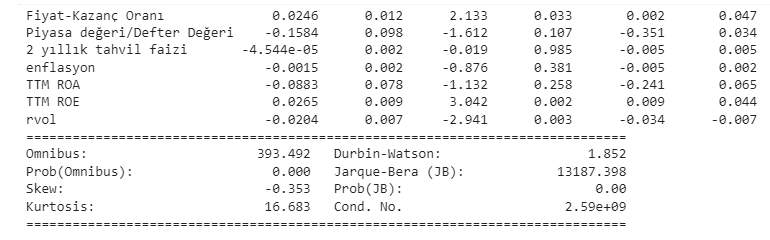

In this case study, Prediction modeling was done with Multivariate regression.

Click on the calculate button to see the portfolio return result!

Result:

As an example, downloading financial data from Yahoo Finance and investing.com via Python for company A is shown.